Provision for Doubtful Debts Double Entry

Iv A provision for bad and doubtful debts is to be created at 5 of debtors. 24000 will be written off as bad debts and a provision of 5 on debtors for bad and doubtful debts Will be maintained.

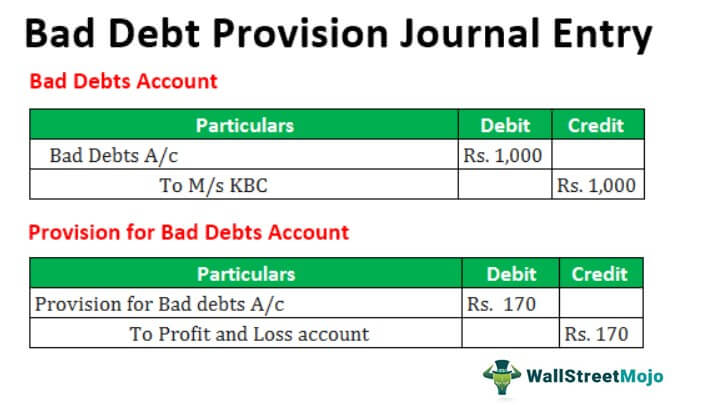

Bad Debt Provision Meaning Examples Step By Step Journal Entries

A provision can be created due to a number of factors.

. Double Entry Book Keeping Ts Grewal Volume I 2021-2022 Solutions for Class 12 Commerce Accountancy Chapter 5 - Admission Of A Partner. Ii An unrecorded creditor of Rs. 6000 have been omitted be recorded in the books.

Pass the necessary journal entries prepare the revaluation account and partners capital accounts and show the Balance Sheet after the admission of C. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an.

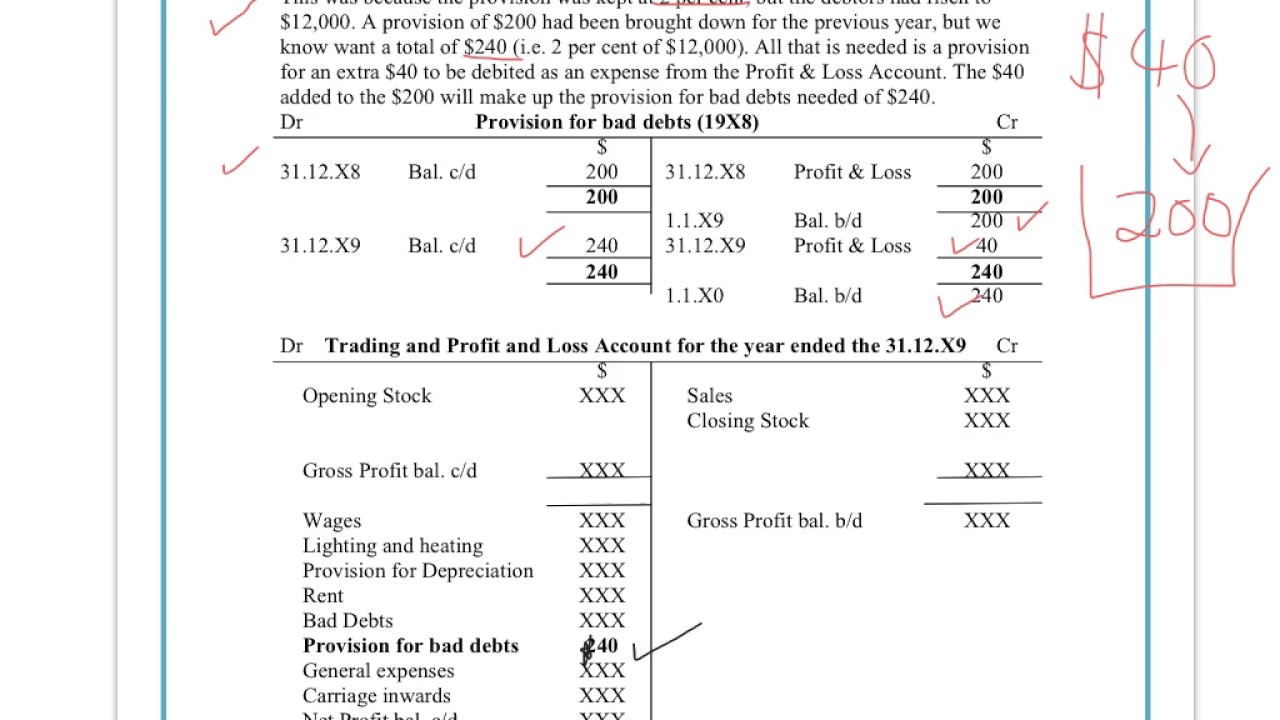

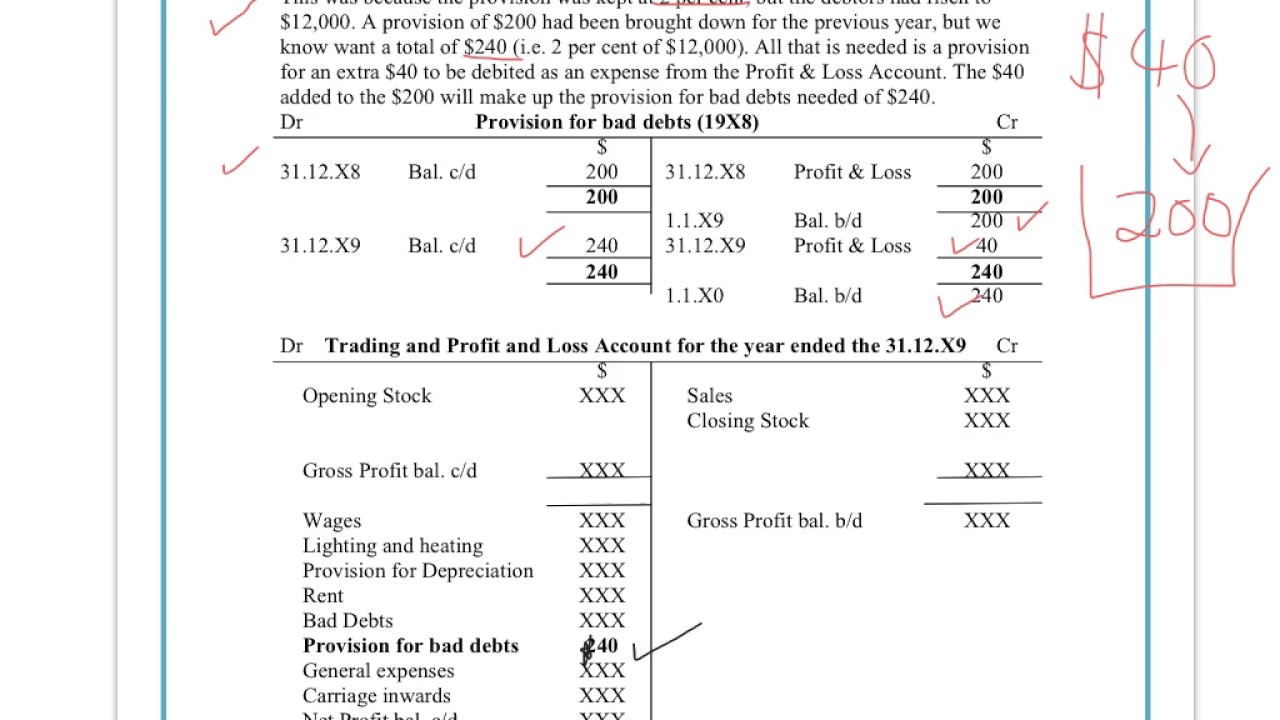

The other examples of provisions are. Treatments to record adjustments for accruals and prepayments bad debts provision of doubtful debts and bad debts recovered are included. The income statement for the year ended 31 December 2016 was debited with 15 for the provision of doubtful debts.

21 The System of Double Entry of Book-Keeping. Iii Provision for doubtful debts Rs. Carrying value of asset after the above adjustment would be.

If a business along with its assets and liabilities is transferred by one owner to another the debt so transferred by one owner should be entitled to the same treatment in the hands of the successor. 20000 will be recorded. 5000 are outstanding for salaries.

- The Debtors Ledger - The Creditors Ledger. V Creditors were unrecorded to the extent of 1000. On 1 January 2016 the trade receivables amounted to 3500 and the provision for doubtful debts was 175.

1000 are prepaid for insurance. Anonymous What would be the double entry if a specific provision for doubtful debts which was made is paid in the next year. It is to be noted that in case of decrease in value maximum amount that can be charged to the revaluation surplus account is limited to the remaining balance in surplus account.

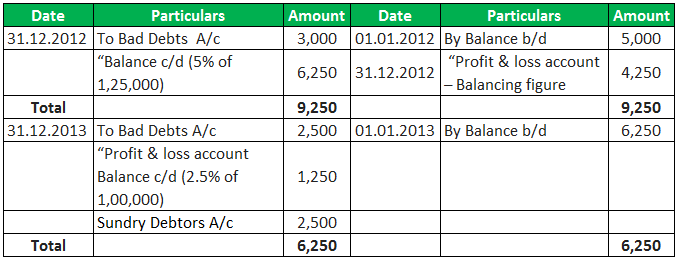

Accounting Adjusting Entries Quiz. B Joint Venture is a temporary partnership. 20 Sumit maintains a position for doubtful debts at 5 of the trade receivables at the end of each financial year.

The solution for this question is as follows. The following year if you felt the provision needed to be lowered as the potential bad debt was now paid and future debts did not have the same likelihood of going bad then you could cancel. Iii Patents will be completely written off and 5 depreciation will.

Outline the double entry system of book-keeping. In that case there is a revaluation loss of 16667 ie. Try Another Double Entry Bookkeeping Quiz.

Iii A claim for 16000 for workmens compensation was admitted. Specific Provision for Doubtful Debts Subsequently Paid by. Guarantee product warranties Requirements for creating provision.

5 provision be made for doubtful debts on Debtors and a provision of 2 be made on Debtors and Creditors for discount. 1480 for accrued income are be shown in the books. I Debtors of Rs.

Enter the email address you signed up with and well email you a reset link. Provision for bad and doubtful debts will be increased by 3000. Academiaedu is a platform for academics to share research papers.

It is calculated to cover the cost of debts that are expected to remain unpaid during an accounting period. 6000 v Abnormal Loss of Stock Rs. A Names the items which are recorded at the invoice price in the consignment account.

Inventory valuation and its impact on financial statements. 3000 iv Loss of Goods by theft Rs. Give journal entries passed for the adjustment of loading in respect of each item.

As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below. Bad debts should be written off when accounts are made up ix.

For example here is a debtors ledger with a number of individual. 56667 40000 and company needs to pass adjusting entry as follows.

Allowance Method For Bad Debt Double Entry Bookkeeping

Bad Debt Provision Accounting Double Entry Bookkeeping

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Comments

Post a Comment